Category: image-preview

Bunch Expands TWFG to The Northeast

CHRON.COM By Catherine Dominguez, cdominguez@hcnonline.com

For The Woodlands businessman Gordy Bunch, expanding his company to the Northeast was just the next step in his effort to continue his successful financial business, The Woodlands Financial Group.

“It was always our intention to be a fully national company,” Bunch said. “This helps us plug the largest remaining hole.”

Bunch, who also serves as chairman of The Woodlands Township Board of Directors, founded TWFG in 2001 with $10,000 and is on track to top a half-billion dollars in sales this year.

“Area growth has been fairly consistent over the last 16 years,” Bunch said. “We planned to get here and we plan to get farther. If you had asked me in 2001 that I would have a half-billion in sales, I would have said, ‘You’re crazy.'”

The expansion will include the Middle Atlantic and Northeast states of New York, Pennsylvania and New Jersey.

Leading that effort will be Vic Cordone, a 37-year Allstate veteran and a former principal of FMJ Agency Alliance, Bunch said. Bunch said Cordone’s insurance industry experience and contacts will enable him to immediately begin recruiting independent and captive agents to set up TWFG branches in the target states. Cordone is tasked with adding 100 to 150 agencies to the national TWFG family. TWFG lists more than 300 retail branches in 22 states and has 3,000 affiliations with independent agents in 38 states.

“I am excited to offer these new independent agency opportunities to my longtime friends and new associates in New York and the Mid-Atlantic states,” Cordone stated in a release. “TWFG provides a complete agency management system, access to personal and commercial carriers, training, and back office support.”

Cordone will be based in New Jersey and will personally handle brokering agents in the new wholesale and retail markets.

For more information about TWFG, visit www.twfg.com.

Cordone can be contacted at 732-513-7994 or vcordone@twfg.com.

Posted in image-preview, news-articleThe Woodlands Financial Group Expands Agency Recruiting and Branches into Northeast States

By The Woodlands Financial Group

| Published 05/18/2017

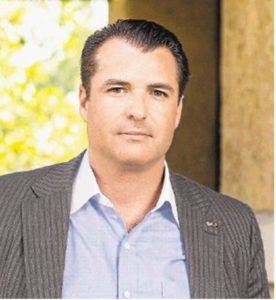

Vic Cordone will help TWFG expand reach to northeast states.

THE WOODLANDS, Texas — The Woodlands Financial Group (TWFG), which has grown to become one of the top national agencies from its base in Texas, is launching a strong effort to expand TWFG into the Middle Atlantic and Northeast states of New York, Pennsylvania, and New Jersey.

Vic Cordone, a 37-year Allstate veteran and a former principal of FMJ Agency Alliance, will lead the new business thrust, according to Gordy Bunch, president and CEO of The Woodlands Financial Group.

Bunch said Cordone’s insurance industry experience and contacts will enable him to immediately begin recruiting independent and captive agents to set up TWFG branches in the target states.

Cordone is tasked with adding 100 to 150 agencies to the national TWFG family. TWFG currently lists more than 300 retail branches in 22 states and has 3,000 affiliations with independent agents in 38 states.

Cordone said, “I am excited to offer these new independent agency opportunities to my long-time friends and new associates in New York and the Mid-Atlantic states. TWFG provides a complete agency management system, access to personal and commercial carriers, training, and back office support.”

Cordone will be based in New Jersey and will personally handle brokering agents in the new wholesale and retail markets.

He can be contacted at 732-513-7994 or vcordone@twfg.com.

For more information about TWFG, visit www.twfg.com

Related Links

TWFG – The Woodlands Financial Group Directory Page For more information about TWFG

Posted in image-preview, news-articleTime to Graduate Your Own Insurance

It’s time for 1.85 million college students to don cap and gown for graduation ceremonies. As they make the transition from undergraduates to careers, pursuit of advanced degrees, or back into mom and dad’s nest, it’s critical that they understand how walking across that stage may have changed their insurance needs.

Auto Insurance – A shiny new car, whether owned or leased, holds appeal for newly employed college grads. Auto insurance helps cope with the expenses of accidents, vandalism or theft. If a graduate who already owns a car is moving, where they keep and register the car, especially from one state to another, can impact coverage.

Homeowners or Renters Insurance – College grads starting out may rent an apartment or a house. To make sure possessions are protected renters insurance offers comprehensive coverage whether at home or traveling. When bringing a classmate home for a visit, their parents will ensure their welcome includes protection in their Homeowners policy for any accidental mishaps to guests in the home. No one wants to turn a friendship into a lawsuit.

Health Insurance – Apparently, under existing or proposed federal health care law, children can remain on their parent’s health insurance coverage until age 26. With unemployment and under-employment high among those in their early twenties, this can provide many recent grads with health insurance.

Disability Insurance – This is a vital but often-overlooked insurance coverage. It provides income when a person is injured or disabled, whether on the job or off. Life Insurance – New grads may find a job with an employer that offers group term life insurance coverage. However, those with children may find it worthwhile to buy additional term life insurance or permanent life insurance, which builds cash value over time.

For article ideas or to contact us, please email gordy@twfg.com

By TWFG – The Woodlands Financial Group – Visit Our Business Directory Listing

Posted in image-preview, news-articleThe Woodlands Township Chairman Heads to Washington for Donald Trump Inauguration

By Kim Kyle Morgan, Woodlands Online

THE WOODLANDS, Texas – Gordy Bunch, chairman of The Woodlands Township Board of Directors and founder, owner and CEO of The Woodlands Financial Group, is heading to Washington with his wife Michelle for the inauguration of President-elect Donald Trump.

Woodlands Online chatted with Bunch about his upcoming trip to witness the swearing-in of the 45th president.

WOL: What, in your opinion, makes this a historical event?

GB: You’re dealing with a situation where someone has been elected the most powerful man in the world without ever holding public office in the past. I want to see what an entrepreneur can do in a leadership role.

WOL: You’ve spent several hours visiting with Trump right here in The Woodlands over the last few years. What strikes you the most?

GB: I’ve spent time talking with him about international affairs, from China’s devaluing the currency to Iran’s ambitions to get a nuke, to immigration challenges along the southern borders. He is a very approachable and knowledgeable man on many subjects. Although his commentary throughout the campaign didn’t really reflect well on him, he has a lot more substance to him than came out in the campaign and I hope to see him put that into action as our new president.

WOL: Where do you think he will make the biggest impact in the shortestamount of time?

GB: The absolute credibility he has toward negotiating agreements that are favorable to our country. Just look at what’s happening in the automobile industry — these plants that were slated to go to Mexico all of a sudden changed their minds and have decided to stay in the U.S.

I also think he will be quick in dealing with Congress and House reps that for years have passed the buck. I can see him calling them out.

Longer term, I’m encouraged by the possibility of real tax reform for all Americans. The repeal of Obamacare is coming up the pipe. And, as a veteran, seeing the reduction in forces and a lack of investment in our military infrastructure has been disheartening. I’d like to see Trump move us in a different direction.

WOL: What do you think about elected officials boycotting the inauguration?

GB: It reflects poorly on their maturity and leadership. The Office of the Presidency is a representation of our country regardless of party affiliation, and it is owed respect regardless of who’s in the chair. I don’t ever recall hearing about Republican protests or the independent protests of any president ever elected. It’s a reaction to today’s pop culture, reality TV and sensationalism. I don’t think it moves the needle on bringing our country together in any way, shape or form.

WOL: What are your thoughts on the next four years?

GB: There’s really no excuse going forward for the Republican Party to show what it can do. With the House and Senate in Republican control, I want to see some progress. I’m looking forward to seeing what can happen with Trump as leader.

Posted in image-preview, news-articleTWFG Earns No. 1 Rank for Personal Lines Insurance in Texas

The Courier

Business Briefs

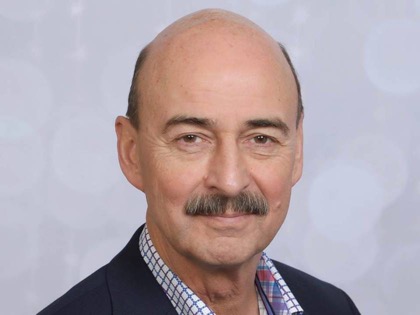

Gordy Bunch

A new report from Insurance Journal magazine ranks TWFG Insurance Services as No. 1 in Texas for Personal Lines (Homeowner and Auto) insurance revenue among the Top 50 independent Personal Lines national leaders.

Gordy Bunch, president and CEO of The Woodlands Financial Group, responded to another year of TWFG earning the top spot in Texas.

“We are number one because our branches everywhere build strong relationships with families – our customers. We don’t compromise quality of coverage just to offer a lower price, leaving our customers vulnerable in the future,” he said. “Our successful business model allows us to provide hundreds of agents with tools and plans that give TWFG clients the broadest possible options for coverage from more than 200 carriers.”

TWFG also appears in the top ranks of Property and Casualty Insurance, ranking in the Top 30 of the 38,000 independent insurance agencies in the nation, as reported by Insurance Journal. The multi-faceted financial group of companies has another expansion of its national headquarters underway in The Woodlands, Texas. Gordy Bunch founded the company with $10,000 here in 2001. TWFG has grown to become a national agency with more than 300 retail branches in 22 states and 3,000 affiliations with independent agents in 38 states.

Five Things to Know About Woodlands Board Chairman Gordy Bunch

Gordy Bunch

Gordy Bunch, 44, is the new chairman of The Woodlands Township’s governing board, a position akin to mayor. His colleagues selected him after November’s election produced a slow-things-down majority on the seven-member board.

Bunch’s enthusiastic supporters praise him for being aggressive and outspoken in defending the quality of life in the township. Critics call him rigid and uncompromising, attributes that work well for an activist but less so for a politician, they say.

Here are five things to know about Bunch:

Gordy isn’t short for Gordon

His full name is Richard Finley Bunch III. He was on the chubby side as a kid, so his mother nicknamed him “Gordito,” a Spanish term of endearment. Although he grew taller and leaner, “you can’t switch from Gordo to Flaco,” which means skinny, he said. So his mother started calling him Gordy.

He has a “degree in life”

At 19, Bunch drove from College Station to San Diego to join the U.S. Coast Guard. Over the next four years, he responded to hurricanes and floods, helped rescue ships in the Bering Sea and intercepted drug smugglers and human traffickers. He then returned to Texas and got a job selling insurance. He took classes at night for three years but didn’t see an academic degree as necessary for his career. In 2001, he started his own insurance agency, which has grown into one of the largest in the nation.

His house is on shaky ground

Bunch and his wife, Michelle, are among dozens of homeowners who filed suit against The Woodlands Development Co., accusing the developer of negligently constructing their houses on active fault lines. A Harris County judge ruled in favor of the company in February, but Bunch said the couple is appealing. Meanwhile, they are building a new home about a mile away.

Politics run in the family

Michelle Bunch’s uncle was the Montgomery County judge in the 1970s and her father, Fred Thornberry, ran unsuccessfully for Texas agriculture commissioner and for Congress. A quadriplegic since crashing his car in 2009, Thornberry is living with the Bunch family. He gave a pep talk to his son-in-law on the day Gordy announced his opposition to the county’s $350 million bond measure for new and improved roads. “Your job is to represent the people who live within the boundaries of your office,” he told Bunch. “If you do that, you’re doing it right.”

The president-elect is a “very nice guy”

In 2015, shortly before Donald Trump announced his candidacy for president, Bunch paid $25,000 to share a table with him at a fund-raiser for the Texas Patriots PAC, a local tea party group. Bunch said Trump was approachable, intelligent and observant, noting improvements The Woodlands Country Club could make. When Trump returned to the township for a campaign rally months later, he autographed the podium placard for Bunch. The sign is going into the flag room of Bunch’s new house.

Environment Reporter, Houston Chronicle

Posted in image-preview, news-articleThe Woodlands Financial Group Spotlighted By Insurance Peers

By Paul Lazzaro

Published 12/14/2016

THE WOODLANDS, Texas — The national insurance industry has again looked to The Woodlands Financial Group for outstanding performance.

Insurance Business America magazine has selected TWFG Insurance Services as one of America’s “Elite Agencies” in this month’s cover story. Gordy Bunch, president and CEO of The Woodlands Financial Group, notes that only 50 insurance agencies, out of 38,000 in the nation, are given this special recognition each year.

The magazine says their “Elite” list includes independent commercial retail agencies that range from a single office to large corporations with a global presence. “They are leaders in their communities and the industry in terms of revenue, best practices, and community involvement.”

TWFG was also featured as “Best Agency to Work For” in Insurance Journal magazine.

Bunch said he took special pleasure in learning that the recommendations of his employees earned TWFG the 2016 “Best Agency to Work For” bronze medal.

Insurance Journal magazine asked insurance agency employees throughout the nation to complete its “Best Agency” survey and TWFG employees were effusive with their positive comments. TWFG employees responding said the agency’s “Our Policy is Caring” pledge starts at the top in their workplace. One survey respondent wrote that the company’s “owner has great integrity and leadership. He has a heart for helping agents and providing them with the tools they need to succeed.” Another comment described owner Gordy Bunch as “generous with his employees. He is quick to take action when someone is in need. He has provided training and leadership opportunities for each employee.”

TWFG is a national agency with more than 300 retail branches in 22 states and 3,000 affiliations with independent agents in 38 states. TWFG’s national headquarters operates with more than 100 employees located in a suite of offices above The Woodlands Mall.

Bunch was also recently reelected to The Woodlands Township Board of Directors which he now serves as chairman.

For more information about TWFG, visit www.twfg.com.

Posted in image-preview, news-articleSBA Loans are Available to Help Grow Your Business

Jonathan Foster

Bunch

SBA loans are available to help grow your business

Bunch

April 29, 2016 4:21 pm

SBA loans are available to help grow your business

Being undercapitalized is one of the main reasons that small businesses have high failure rates. Under-capitalization also can hinder the growth of your business. SBA loan programs are available that can help you launch or expand your business. If you are faced with this impediment to growth, look into U.S. Small Business Administration loan programs for financial help through an SBA-approved lender. SBA 7(a) Loans offer up to $5 million to expand, renovate, construct facilities, and refinance loans or for working capital needs. This program offers long-term financing options that can benefit near-term cash flows. The SBA also has a 7(A) Small loan program for loans below $350,000 with similar terms.

SBA Express Loans range up to $350,000 with maximum seven-year maturities. Rates will be higher than loans under the regular 7(a) program, but the process is streamlined to be faster and offer easier access to lines of credit.

The SBA Veterans Advantage program is available to businesses that are at least 51 percent owned by veterans, their spouses or widowed spouses of those who died during active duty or through a service-related disability. This program is designed to help those who protected and served our country. Loan proceeds and values are the same as the 7(a) program with SBA guarantee fees waived for 7(a) loans and reduced by 50 percent for SBA Express loans.

SBA Cap Lines programs offer up to $5 million toward working capital, contract financing, seasonal cash flow and construction for commercial or residential builders. Loans are available up to 10 years for non-builders and up to five years for builders.

These SBA loan programs are among the most commonly available through the SBA; however, there are several more you can review that support international trade, export working capital, 504 development and non 7(a) micro loans programs.

You will need to put together a business plan, financial pro forma, credit references and make sure your business type is SBA approved. For veterans, you will need your DD 214 to verify your service eligibility if using the SBA Veterans Advantage program. All businesses that choose to apply must be able to demonstrate good credit, management skills and ability to repay.

If you are interested in more detailed information you can visit www.sba.gov or submit questions via e-mail to questions@sba.gov. I would also encourage you to meet with your local banking relationship to see if they are approved lenders and which SBA programs they support. They can also be helpful in assisting with the application process.

Richard “Gordy” Bunch is the EY Entrepreneur of the Year® for the Gulf Coast for Products and Services. He is also the founder, president, and CEO of The Woodlands Financial Group based in The Woodlands, Texas. You may submit suggested topics for future business columns to him at gordy@twfg.com.

Posted in image-preview, news-articleMuddy Trails Bash Highlights TWFG’s Mission of Caring

By Paul Lazzaro

THE WOODLANDS, Texas – Gordy Bunch, TWFG president and CEO and The Woodlands Financial Group are community winners even before the 2016 TWFG Muddy Trails Bash series of fun-runs kicks off on Saturday, April 2.

“This is one of the most popular kids’ events in a community built for kids and families,” Bunch said. “TWFG’s slogan states that ‘Our Policy is Caring,’ and Muddy Trails Bash is just one of multiple community events we support because they combine physical fitness with fun.”

Bunch says caring for your community is integral to doing business in the community.

“TWFG was founded in The Woodlands. We live in The Woodlands. We operate our national business from our Woodlands headquarters here in Town Center. Muddy Trails Bash is only one of the ways we demonstrate the sincerity of our company and our employees to thank and benefit all Woodlands’ families.”

As an IronMan participant and sponsor, Gordy believes in physical fitness, which is why TWFG’s philosophy of giving centers on fitness and healthy living. TWFG is also title sponsor for the Gran Fondo bicycle race benefitting the Houston Medical Center Orchestra and the National Multiple Sclerosis Society. TWFG supports The Woodlands Marathon, and a host of charitable organizations.

Other beneficiaries of TWFG’s “Caring” policy are American Heart Association, Susan G. Breast Cancer Foundation, Barnabus Group, Interfaith of The Woodlands, Toys for Tots, CASA Child Advocacy, College of the Ozarks, University of North Texas, Texas A&M University, University of Houston-Downtown Advisory Board; The Woodlands Waterway Arts Council; Fellowship of Christian Athletes; Texas Rush (Kid’s Soccer), The Women’s Center, Young Life, The Woodlands United Methodist Church, and JROTC.

The 2016 TWFG Muddy Trails Bash events take place from 3 to 8 p.m. at the George Mitchell Nature Preserve, Rob Fleming Park in the Village of Creekside Park. Organizers have announced all events will be run “rain or shine.”

A crawfish plates and Zydeco music feast follow timed 5K and 10K races for ages 10 and older, Little Muddy Kids one-mile Fun Run for ages 5 and up, and even a 2K Dog Fun Run for the whole family.

Posted in image-preview, news-articleThe New Umbrella of Flood Insurance

Gordy Bunch, President & CEO, TWFG Insurance Services.

HOUSTON, June 8, 2015 /PRNewswire/ — 2015 is already on the record books as one of the worst years of flooding in U.S. history. The nation’s Midwest and Gulf Coast communities are afloat with homes, vehicles, trees, and personal belongings as the result of record-breaking rainfalls.

More than 163 billion gallons of rain deluged the Houston area alone. For the fortunate few who signed up for policies tied to the National Flood Insurance Program (NFIP), rebuilding will be less painful and less costly, says Gordy Bunch, president and CEO of The Woodlands Financial Group (TWFG). Bunch is a national FEMA flood agency award winner and a director of The Woodlands Township, a premier master-planned community just north of Houston with 30,000 homes.

The National Oceanic and Atmospheric Administration has assigned a “major” rating to recent flooding in the states of Texas, Oklahoma, Louisiana, Alabama, and Arkansas. Minor to moderate flooding has occurred in Missouri, Kansas, Nebraska, Colorado, South Dakota, and Wyoming. The threat of flooding is about to become compounded by the Hurricane Season which usually affects Florida and the East Coast. High tide floods have been forecast in 2015 by NOAA.

FEMA’s new flood insurance program went into effect on April 1, 2015, so Bunch cautions that the new program could affect policy holder rates and deductions. Thousands of homeowners and small business firms may need to pay higher premiums regardless of the extent of their damage.

The Federal Emergency Management Agency (FEMA) says flood insurance is an essential ingredient for protecting your family. Too many victims of this year’s flooding felt a false sense of safety because they thought their homes were situated above flood waters, says Bunch. The Blanco River in Texas, which normally crests at 13 feet, reached 44.5 feet. Bunch always reminds customers that their homeowners policies do not cover flooding. Flood insurance fills that void and if your insurer participates in the NFIP program you can file claims even if a storm situation does not trigger a federal disaster declaration. If your home is listed in a flood plain, your mortgage company will insist that you buy flood insurance.

The NFIP has 5.3 million policyholders in homes and businesses across the country with $1.3 trillion of insurance coverage in force. Among the many FEMA changes which were combined with new flood maps identifying Special Flood Hazard Areas (SFHA) are:

Increased fees for most policies.

New deductible options with a maximum of $10,000 for single family homes and two-to-four family dwellings could result in a 40% discount.

Increase in the Federal Policy Fee.

Limiting increases for individual premiums to 18 percent of premium.

Limiting increases for average rate classes to 15 percent.

“Grandfathering” can provide a lower-cost rating for policies in force when the new flood maps became effective.

Gordy Bunch recommends that prospective or renewing policy holders go to FloodSmart.com for more information and updates from FEMA.

For Media Information:

Gordy Bunch 713-416-0789

gordy@twfg.com

SOURCE The Woodlands Financial Group

RELATED LINKS

http://www.twfg.com